Tentative Agenda

1) Numerical Methods and Computational Finance

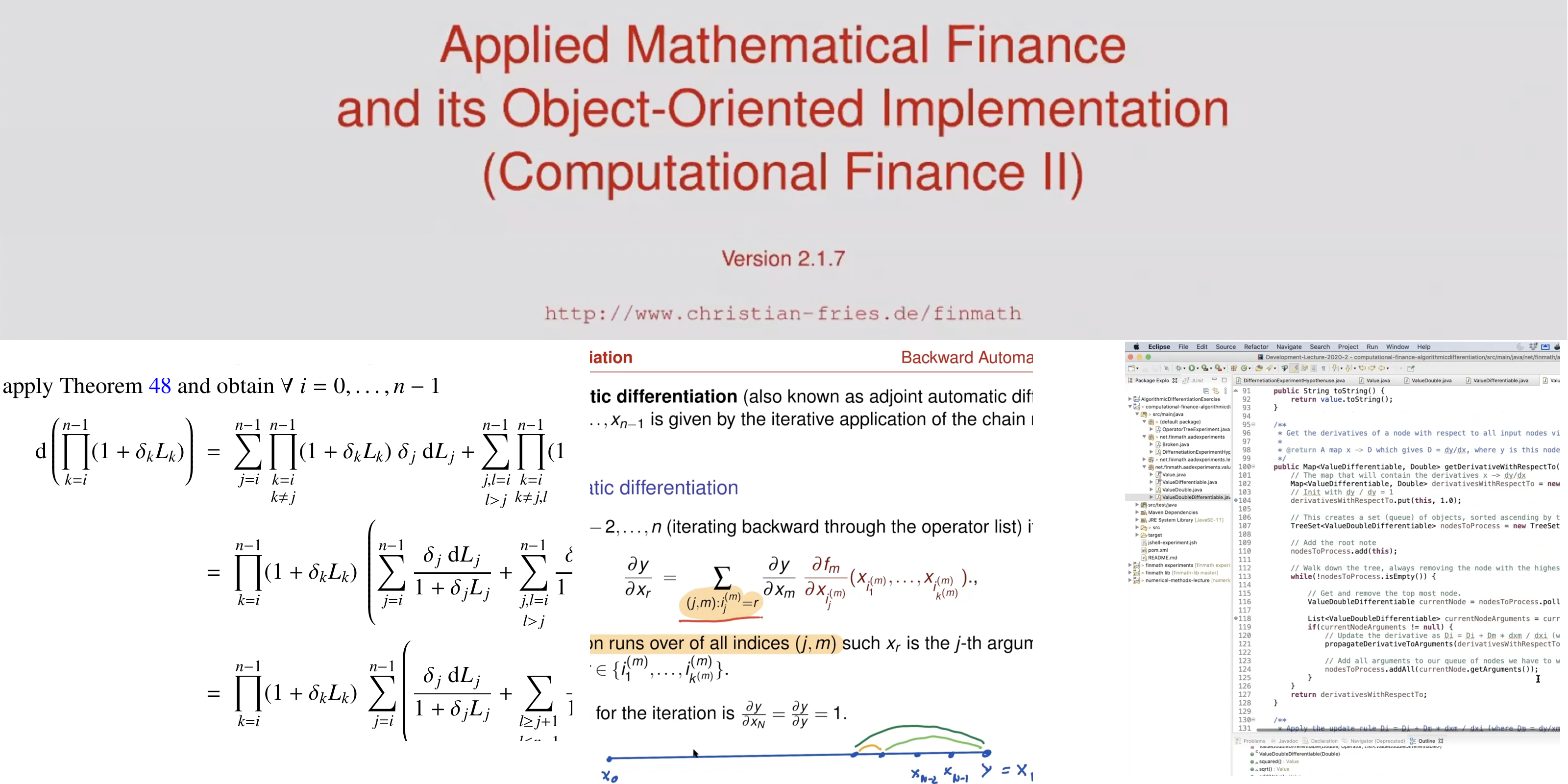

- Algorithmic Differentiation / Adjoint Algorithmic Differentiation

- Stochastic Algorithmic Differentiation

- Monte-Carlo Simulation on GPUs (NVIDIA Cuda and OpenCL)

2) Hybrid Market Models, Complex Derivatives and their Object-Oriented Implementation

- Foundations in mathematical finance and their implementation (stochastic processes)

- Interest Rate Models

- Hybrid Market Models (Cross-Currency Modeling, Equity Hybrid Model, Defaultable LIBOR Market Model) and their object oriented implementation

- Definition of model interfaces

- The valuation of complex derivatives

- Model calibration

- Special topics from risk management

The lecture covers the object oriented implementation of the algorithms in Java and using modern software development tools.

As part of the implementation of the models and the valuation algorithms, the lecture will discuss some of the latest standards in software development.

- revision control systems (Git)

- unit-testing (jUnit)

- build management (Maven, Gradle)

- continuous integration (TravisCI, Jenkins)

Implementation will be performed in Java (Eclipse, IntelliJ)

- Trainer/in: Roland Bachl

- Trainer/in: Christian Fries

- Trainer/in: Andrea Mazzon