- Trainer/in: Mark Hamilton

- Trainer/in: Enric Solé-Farré

- Trainer/in: Sabine Jansen

- Trainer/in: Jan von Delft

- Trainer/in: Alejandro Caicedo

- Trainer/in: Mark Hamilton

- Trainer/in: Elias Haslauer

- Trainer/in: Andreas Rosenschon

- Trainer/in: Simon Weinzierl

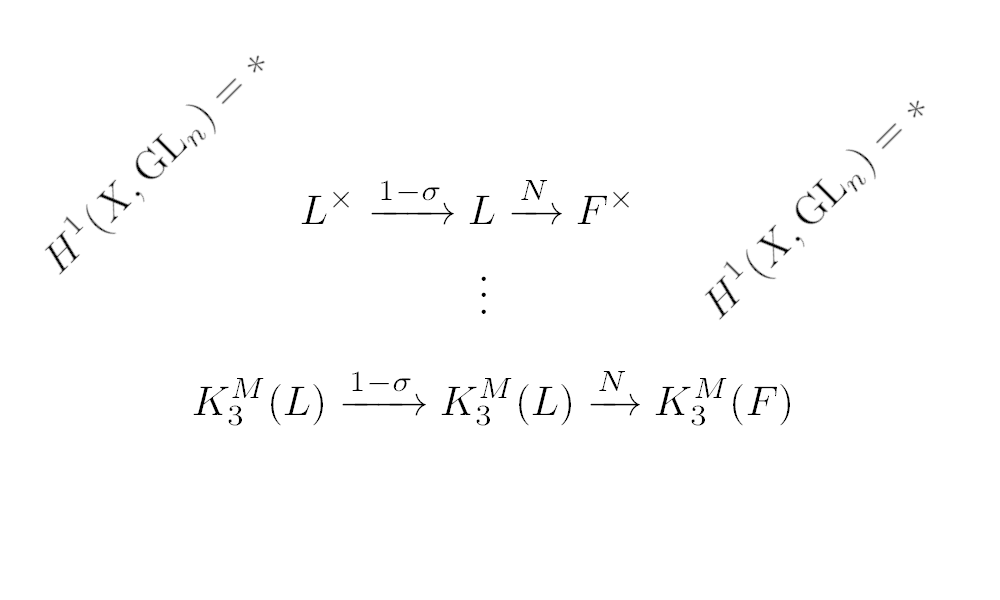

In diesem Modul werden fortgeschrittene Methoden und Techniken der Algebra und kommutativen Algebra, sowie grundlegende Begriffe der homologischen Algebra eingeführt. Insbesondere werden grundlegende Begriffe wie Dimension, Ganzheit, Lokalisierung und Tensorprodukte behandelt und die für die affine algebraische Geometrie benötigten Sätze der kommutativen Algebra wie, zum Beispiel, Hilbert’s Basissatz, Hilbert’s Nullstellensatz oder Noether Normalisierung, bewiesen.

- Trainer/in: Andreas Rosenschon

- Trainer/in: Simon Weinzierl

- Trainer/in: Werner Bley

- Trainer/in: Sohir Maskey

- Trainer/in: Pascal Stucky

- Dozent: Dieter Kotschick

- Dozent: Jonas Stelzig

This lecture introduces into the arbitrage theory of fixed income

markets and interest rate/credit derivatives. Topics that are covered

include

- Introduction to interest rates and interest rate derivatives: bonds, various interest rates, swaps, caps, floors, swaptions, market conventions

- Arbitrage pricing: portfolios, arbitrage, hedging valuation

- Short-rate models

- Affine term structure models

- HJM models

- Forward measures

- LIBOR market models

- Credit risk and Related Contracts

- Structural Models

- Reduced-Form Models

- Trainer/in: Thilo Meyer-Brandis

- Trainer/in: Annika Steibel

- Trainer/in: Lukas Böke

- Trainer/in: Thomas Vogel

- Trainer/in: Noela Müller

- Trainer/in: Konstantinos Panagiotou

- Trainer/in: Simon Reisser

This course is an introduction into the theoretical concepts and modeling approaches of quantitative risk management.

The first part of the course covers various methods from probability and statistics to model market, credit and operational risk. This includes multivariate models, dimension reduction techniques, copulas and dependence modeling, risk aggregation, redibility and insurance risk theory. The second part of the lecture then

focuses on portfolio allocation and stochastic optimal control.

- Trainer/in: Lukas Gonon

- Trainer/in: Niklas Walter

- Trainer/in: Roland Bachl

- Trainer/in: Christian Fries

- Trainer/in: Andrea Mazzon

- Trainer/in: Adalbert Fono

- Trainer/in: Gitta Kutyniok

- Trainer/in: Mariia Seleznova

- Trainer/in: Adalbert Fono

- Trainer/in: Gitta Kutyniok

- Trainer/in: Nico Baierlein

- Trainer/in: Thomas Beekenkamp

- Trainer/in: Markus Heydenreich

- Trainer/in: Christian Lange

- Trainer/in: Bernhard Leeb

- Trainer/in: Panagiotis Papadopoulos

- Trainer/in: Anna Ribelles Pérez